Publisher description

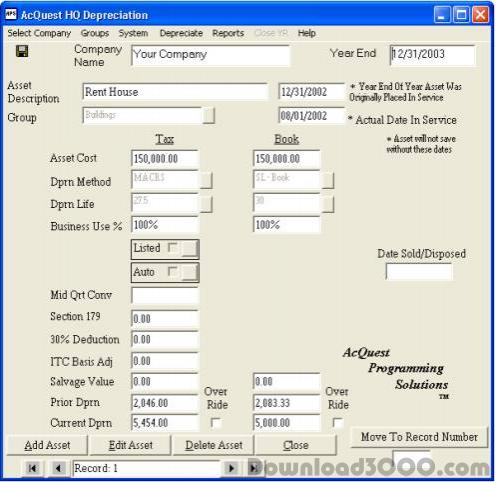

AcQuest HQ Depreciation is designed to run on Windows XP, Vista, & Windows 7. The unregistered version will calculate federal and GAAP depreciation, with the unregistered version limitation that open years cannot be rolled forward. AcQuest HQ Depreciation uses Microsoft Jet database files to store asset information providing for easy manipulation with programs such as Microsoft Access. Supports most deprecation methods, including MACRS, 150% MACRS, MACRS straight line, ACRS, ordinary straight line, 200% 150% and 125% declining-balance, and amortization. Online help and depreciation instructions.

Related Programs

AcQuest Pro Depreciation for accountants.

ASSET DEPRECIATION TOOL FOR EXEL 3.12.10130

Easy to use Asset Register Template for Exel

All-In-One Home Inventory & Asset Manager

IntelliTrack Fixed Asset Tracking Software.

Tracks Fixed Assets and Depreciation.